URD 2022

-

1Financial and accounting information

-

1.1.Review of the Group's business and consolidated results

1.1.1.Events of the financial year

1.1.1.1.Notable facts

ECONOMICAL CONTEXT LINKED TO COVID-19, SHORTAGE OF ELECTRONICS COMPONENTS AND MILITARY CONFLICT IN UKRAINE

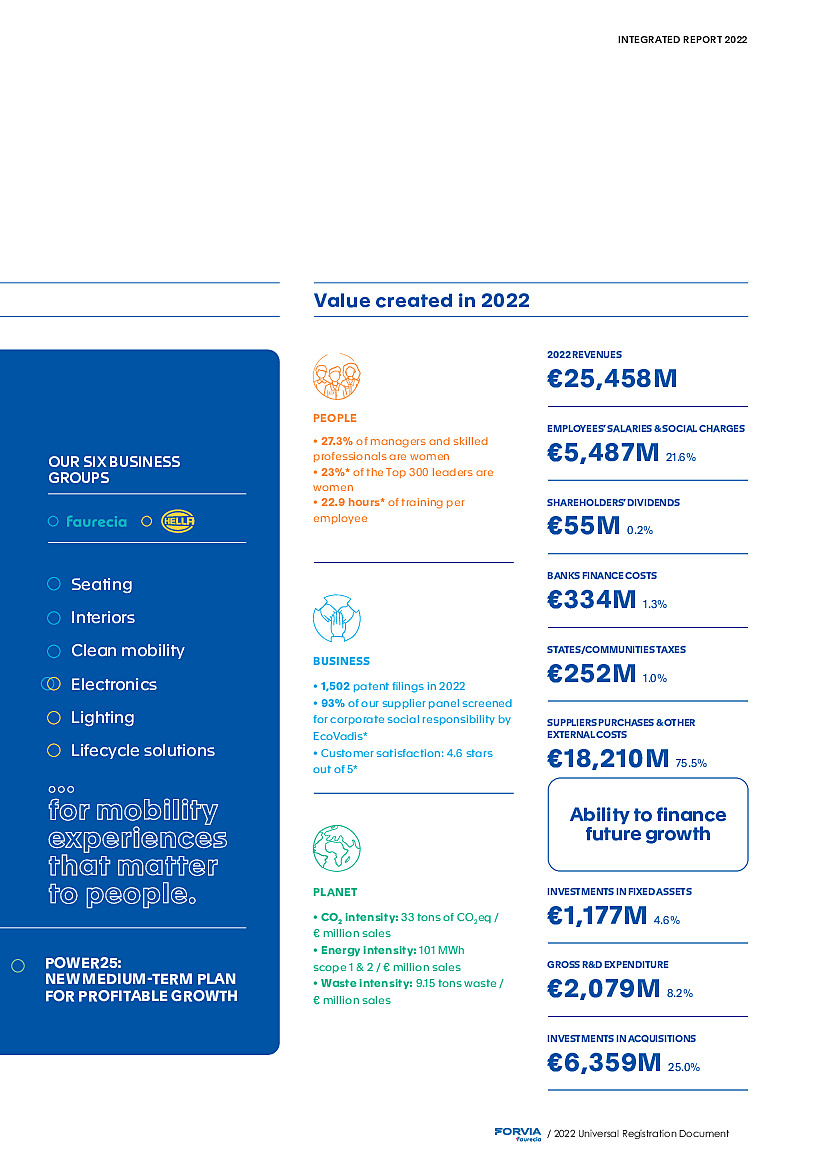

In 2022, worldwide automotive production grew by 6.7% vs. 2021, from 77.2 million LVs in 2021 to 82.4 million LVs in 2022. It remains significantly below the 89 millions LVs recorded in 2019, before the Covid crisis. The first-half of the year was down 1.1% year-on-year, mostly impacted by Q1 (down 3.5% vs. Q1 2021) that recorded the outbreak of the war in Ukraine in February, while the second half was up 14.8%, mostly reflecting the very low base of comparison of Q3 2021.It was penalized by Stop and Gos from OEMs consequent to supply chain disruptions due to the war in Ukraine, by the continued shortage of semiconductors and the Covid developments in China :

- ■China was strongly penalized by the Covid-related restrictions implemented in April and May (Q2 2022 automotive production in China was down 4.7% year-on-year) and then by the increase in Covid cases late 2022, after the decision to end the zero Covid policy (Q4 2022 automotive production in China was down 5.5% year-on-year);

- ■Europe was strongly impacted by Stop & Gos related to supply chain disruptions due to the war in Ukraine and the continuous shortage of semiconductors with H1 2022 automotive production in Europe down 11.3% year-on-year vs. H1 2021, of which -17.5% in Q1 2022;

- ■shortage of semiconductors for the automotive industry continued throughout the year and could gradually ease in 2023, while it is unlikely to resolve entirely before 2024;

- ■lastly, from a macroeconomic standpoint, 2022 has been characterized by additional challenges: high inflation has broadened out across countries, energy supply risks have pushed prices up and interest rates have risen to curb inflation.

As regards to the Group’s very limited activity in Russia (sales represented 0.4% of total consolidated sales in 2022 vs. 1.4% in 2021), due to the war in Ukraine, OEMs’ decisions regarding their operations in Russia and the uncertain and complex environment, Faurecia has decided to disengage from Russia and has depreciated related assets in 2022. The detailed accounting impacts are described in note 6. The group is not present in Ukraine.

1.1.1.2.Main events

January 2022

- ■ Faurecia has announced a partnership with BMW group to integrate the Faurecia Aptoide Automotive App Store in future vehicles. The App Store enable an innovative and seamlessly connected app offering in the new models of the world’s leading premium car and motorcycle manufacturer.

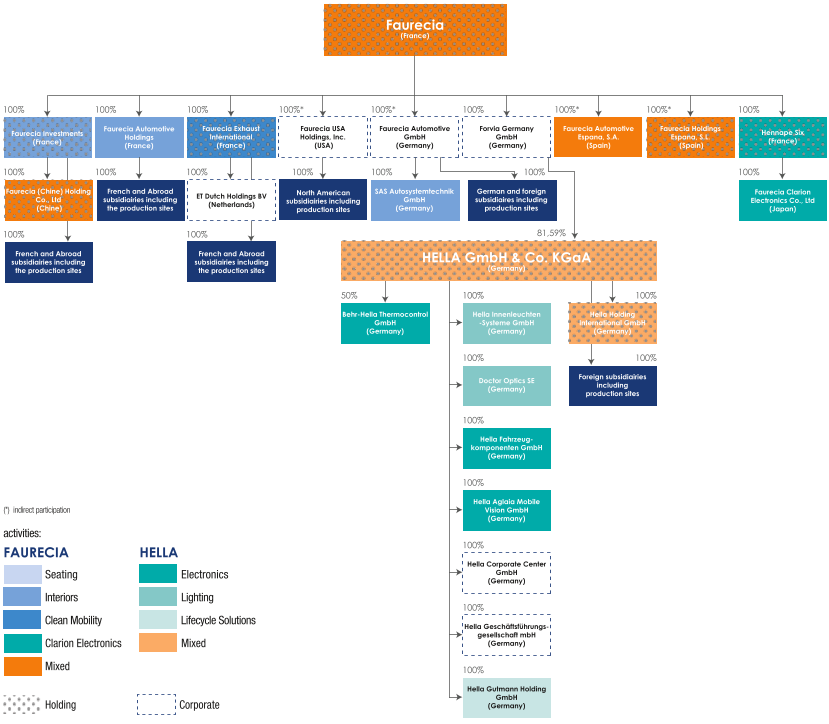

- ■On January 31, 2022, Faurecia announced the closing of the HELLA transaction, in line with the indicative timetable. Faurecia now owns a controlling stake exceeding 80% of the shares of HELLA and will consolidate HELLA in its financial accounts as from February 1, 2022. As a result of the transaction, the Hueck and Roepke Family pool received 13,571,385 newly issued shares of Faurecia, thus becoming Faurecia’s main shareholder with c. 9% of its share capital. The Family pool agreed to be subject to a first lock-up of its Faurecia shares during 18 months as from the closing date and a subsequent lock-up of 12 additional months for the portion of its Faurecia shares exceeding 5% of the Faurecia share capital.

March 2022

- ■Faurecia, selected to partner on the hydrogen fuel cell research project, “Bavarian fleet”, with MAN.

- Faurecia announced that the Company will equip a Bavarian fleet (Bayern flotte) of heavy-duty trucks provided by MAN with complete hydrogen storage systems, as part of a state-supported fuel cell research project.

- For this project, backed with about €7 million funding from Bavarian Ministry of Economic Affairs, Regional Development and Energy, Faurecia, part of group FORVIA, will develop and seek certification for a new size of tank perfectly adapted to meet the requirements of heavy-duty vehicles and other applications with intensive use cases.

April 2022

- ■The California Energy Commission (CEC) has selected Symbio, Michelin, Faurecia along with GTI and other industry partners, to develop and demonstrate a hydrogen-fueled, regional-haul Class 8 truck, as major contributors to a state-supported hydrogen mobility project.

- The “Symbio H2 Central Valley Express” project, will develop and demonstrate a hydrogen fuel cell truck that matches the performance of a 15-liter diesel truck providing a zero-emission solution for demanding regional-haul trucking operations. This hydrogen truck project strives to support California’s goal to achieve economy wide carbon neutrality by 2045.

- ■Faurecia has announced a worldwide long-term partnership with Mercedes-Benz group AG to integrate its apps platform, developed in partnership with Aptoide, into the MBUX multimedia system of one of the global suppliers of premium and luxury cars and vans.

- From 2023, the Company will provide a customized app portfolio refreshed multiple times per year to enhance user experience. The Faurecia Aptoide apps platform provides maximum security, privacy and control of content.

May 2022

- ■Faurecia, and Veolia have signed a Cooperation and Research Agreement to jointly develop innovative compounds for automotive interior modules, aiming to achieve an average of 30% of recycled content by 2025. Through this partnership, the two companies will accelerate the deployment of breakthrough sustainable interiors solutions implemented in instrument panels, door panels and center consoles in Europe. Veolia will start the production of these secondary raw materials at its existing recycling sites in France starting from 2023.

- In 2011, Faurecia was the first automotive supplier to introduce a complete range of bio-composite cockpit solutions with NAFILean®. More than a decade later and in around 13 million vehicles, these products' CO2 footprint is 28% lower than that of conventional all-plastic counterparts.

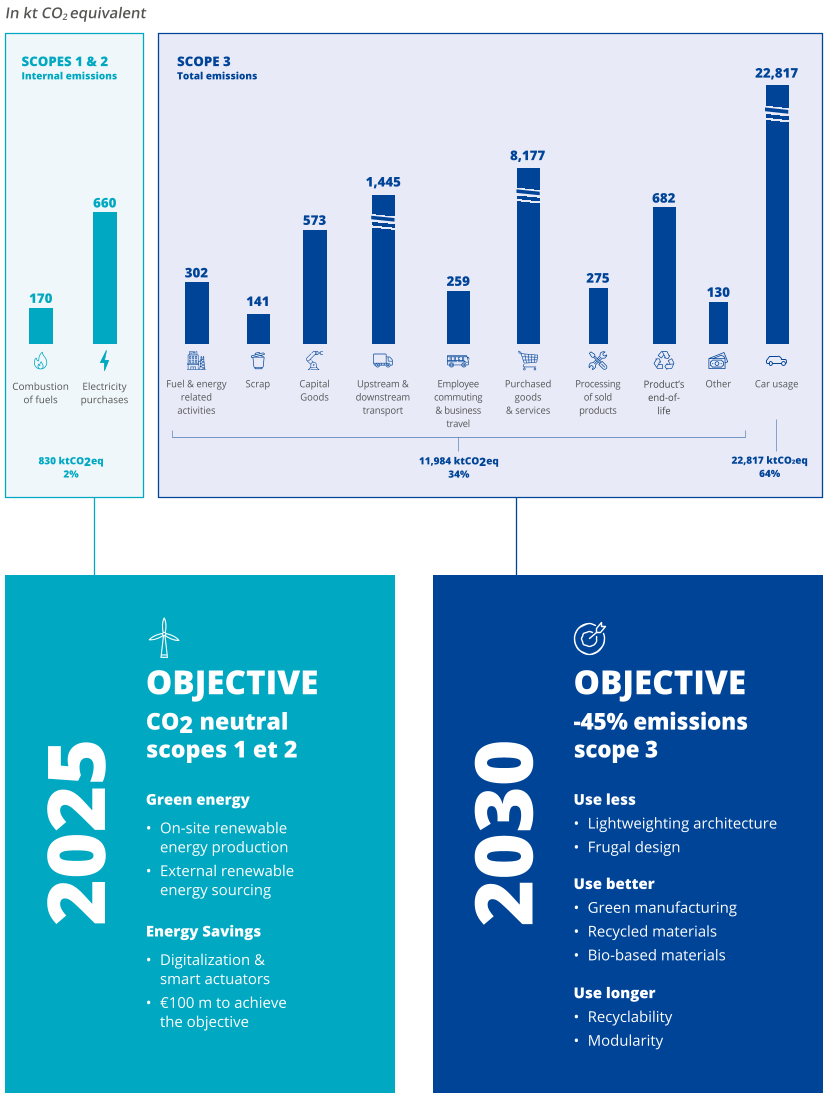

- ■ Faurecia has signed power purchase agreements (PPA) with ENGIE and EDP to equip over 150 sites in 22 countries with solar panels.

- This partnership is a major milestone in Faurecia’s roadmap to become CO2 neutral for its industrial operations (scopes 1 and 2) by 2025.

June 2022

- ■Faurecia in collaboration with the company Air Flow has been awarded a contract to supply high-capacity hydrogen storage containers for refilling stations in the Zero Emission Valley (ZEV), a project involving HYmpulsion.

- The ZEV project aims to deploy, before the end of 2024, 1,200 fuel cell vehicles and 20 hydrogen stations, including several equipped with electrolyzers to produce hydrogen from renewable electricity without emitting CO2.

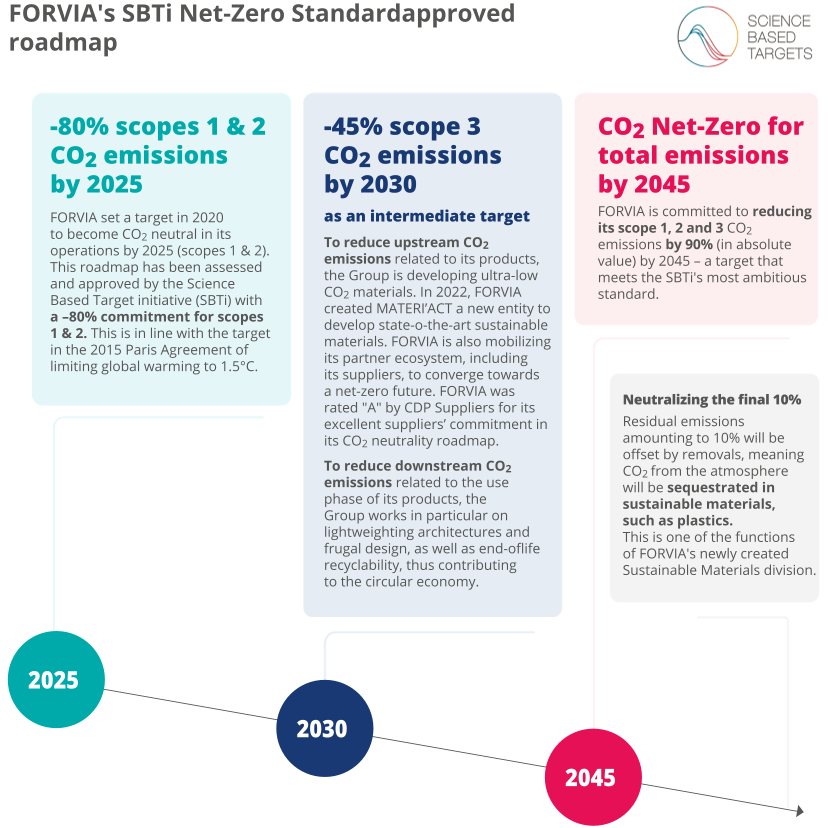

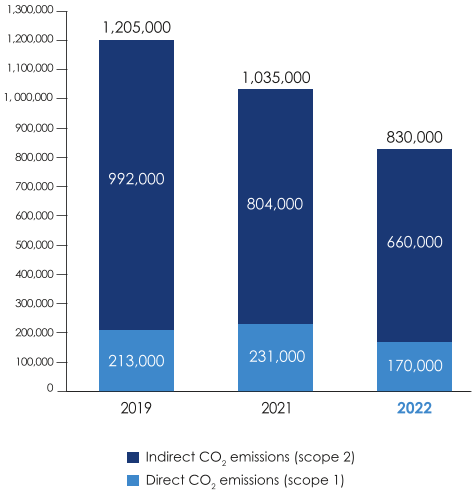

- ■FORVIA, has announced that its joint CO2 neutrality roadmap was validated by the Science Based Target initiative (SBTi) on June 6, 2022. Together, Faurecia and HELLA will reach net zero emissions by 2045 – an objective corresponding to the most ambitious standard of SBTi. Only twenty companies worldwide have had their net zero commitments approved so far.

July 2022

- ■HELLA has agreed the sale of its 33.33% stake in HBPO to its co-shareholder, Plastic Omnium for €290 million.

- ■Faurecia has signed a €315 million loan with the European Investment Bank (EIB). The €315 million transaction is a bullet loan with a maturity of seven years.

- This loan allows Faurecia to enhance its liquidity profile by extending its debt maturity at an attractive financing cost.

September 2022

- ■Faurecia has been integrated into the Euronext CAC 40 ESG® index that comprises the 40 companies within the CAC® Large 60 index that demonstrate the best Environmental, Social and Governance (ESG) practices.

- ■FORVIA exhibited at this year’s IAA Transportation in Hanover, for the first time with its two brands Faurecia and HELLA. Located in Hall 12 Booth B27 & 31, FORVIA will showcase the combined expertise of both companies in the fields of lighting and electronics as well as clean and sustainable mobility.

- ■Faurecia, has announced a $210 million loan with Latin America banks. This transaction is part of the program to finance HELLA acquisition. The $210 million transaction is structured into two tranches in USD and MXN, with a 2028 maturity. Margin above reference rates is close to 3.35% on average which represents an attractive financing cost in the current environment.

October 2022

- ■The zero emissions mobility activities of Faurecia, are selected as being of common European interest. Faurecia and Symbio are among the 10 projects supported by the French government in IPCEI (Important Project of Common European Interest). €2.1 billion are provided to support those 10 projects to accelerate the hydrogen industry in France.

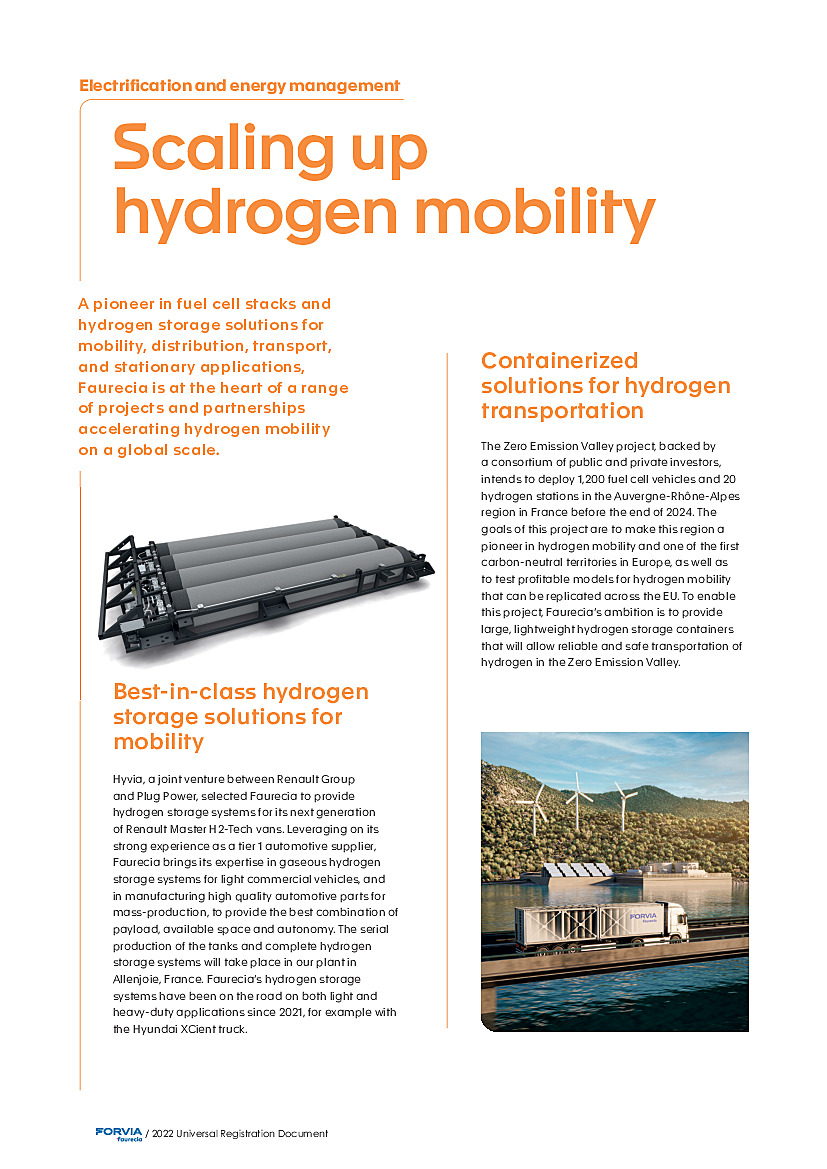

- ■Faurecia, has been awarded by HYVIA, a joint venture between Renault Group and Plug. Faurecia will supply next generation hydrogen storage systems for the mass production of its Renault Master H2-TECH, made in France. The hydrogen storage systems will be produced in Faurecia’s plant located in Allenjoie, France, which has a capacity of over 100k tanks per year.

- ■Faurecia, signed a power purchase agreement (PPA) of Europe’s largest investors in renewable energy, Octopus Energy Generation and Mirova, a management company dedicated to sustainable investment and an affiliate of Natixis Investment Managers. The installed capacity of the project reaches 85.8 megawatts (MW). The wind turbines are located in Alingsas, Sweden. This agreement will support FORVIA’s plan to reach net-zero CO2 emissions by 2045.

November 2022

- ■FORVIA announced the creation of MATERI’ACT, a new brand to massively develop and manufacture cutting-edge sustainable materials. FORVIA is the first in the automotive industry whose "net zero emissions" objective is validated by the Science Based Target initiatives, and thus reinforces its technological advantage in the field to offer mobility experiences that matter to people.

- ■Faurecia and HELLA, operating together as FORVIA hosted their first joint Capital Markets Day, during which the Group presented Power25, its new medium-term plan to drive profitable growth, enhance cash generation and accelerate Group deleveraging.

The ambitions of FORVIA’s Power25 plan are focused on three key strategic priorities:- ■Drive sales growth through innovation and sustainability,

- ■Enhance profitability and lower breakeven,

- ■Generate strong cash conversion and actively manage portfolio to accelerate Group deleveraging.

- They are translated into the following 2025 financial objectives (based on an assumption of worldwide automotive production of 88 million units in 2025 and after the estimated effect of the €1bn disposal program by end-2023):

- ■2025 sales of c. €30 billion,

- ■2025 operating margin > 7% of sales,

- ■2025 net cash flow at 4% of sales,

- ■Net-debt-to-adjusted-EBITDA < 1.5x at December 31, 2025.

- ■FORVIA, has received the prestigious CES 2023 Innovation Award in the category "Vehicle Tech & Advanced Mobility" as "Honoree" for its digital, chip-based "Solid State Lighting | High Definition" (SSL | HD) headlamp system.

- ■Faurecia has successfully priced €700 million in aggregate principal amount of SL Notes at 7.25%. The SL Notes are to be issued under Faurecia's Sustainability-Linked Financing Framework established in October 2021.

December 2022

- ■FORVIA showcased its newest solutions in electrification and energy management, automated and safe driving, and personalized experiences in the digital and sustainable cockpit. Through these technologies, FORVIA illustrated its commitment to becoming carbon-neutral across all operations and products by 2045.

- ■Faurecia, Michelin and Stellantis announced exclusive negotiations for Stellantis to acquire a substantial stake in Symbio, a leader in zero-emission hydrogen mobility, to become a significant player along with existing shareholders Faurecia and Michelin.

January 2023

- ■Faurecia has successfully priced the New Notes, sustainability-linked 7.25% senior notes due 2026 (the “New Notes”) following a private placement arranged by BNP Paribas. Faurecia priced the New Notes at 101.75% of par, or a yield of 6.65%.

February 2023

- ■Faurecia has issued on February 1st, 2023 €250 million of New Notes, sustainability-linked 7.25% senior notes due 2026. The proceeds of the issuance of the New Notes will be used to fully reimburse the Bridge-to-Bond and the Bridge-to-Equity in connection with the HELLA acquisition and for general corporate purposes.

- ■Faurecia has entered in February 2023 into exclusive negotiations with Cummins for the potential sale of a part of its Commercial Vehicle exhaust aftertreatment business. The potential transaction would be subject to customary conditions precedents, including regulatory approvals and completion of applicable employee representative consultations.

- ■Faurecia has announced mid February 2023 to have signed with the Motherson Group an agreement by which Motherson commits to acquire Faurecia SAS Cockpit Modules division (assembly and logistics services), reported as part of its Interiors Segment, for an enterprise value of €540 million. The transaction will be subject to customary conditions precedents, including regulatory approvals.

All press releases related to these events are available on the site www.faurecia.com

-

1.2.Outlook

FORVIA 2023 GUIDANCE

- ■Worldwide automotive production of 82 million vehicles in 2023, broadly flat vs. actual production in 2022 and more

conservative than S&P’s latest forecast of 85 million - ■Main currency rates of USD/€ @ 1.10 and CNY/€ @ 7.50

- ■Sales between €25.2bn and €26.2bn including an estimated impact on sales of €(1.3)bn from disposals announced

to date (mainly SAS deconsolidation as from January 1, 2023, to comply with IFRS 5 and business to be sold to Cummins as

from July 1, 2023) - ■Operating margin between 5% and 6% of sales

- ■Net cash flow exceeding 1.5% of sales

- ■Net debt/Adj. EBITDA ratio between 2x and 2.4x at December 31, 2023, including the effect of the disposal program of €1bn by end-2023

- ■Worldwide automotive production of 82 million vehicles in 2023, broadly flat vs. actual production in 2022 and more

-

1.3Consolidated financial statements

In the financial statements reported thereafter, please note that :

- ■figures reported for the year 2021 are figures related to Faurecia "stand-alone" as reported in February 2022 ;

- ■figures reported for the year 2022 include the major impact of HELLA consolidation since February 1st 2022 (i.e. 11 months in 2022).

1.3.1.Consolidated statement of comprehensive income

(in € million)

Notes

2022

2021

Sales

4

25,458.2

15,617.8

Cost of sales

5

(22,234.1)

(13,734.4)

Research and development costs

5

(896.7)

(330.9)

Selling and administrative expenses

5

(1,212.5)

(690.8)

Operating income (before amortization

of acquired intangible assets)4

1,114.9

861.7

Amortization of intangible assets acquired in business combinations

11

(218.6)

(92.6)

Operating income (after amortization

of acquired intangible assets)896.3

769.1

Other non-recurring operating income

6

1.8

6.0

Other non-recurring operating expense

6

(451.0)

(244.5)

Income from loans, cash investments and marketable securities

51.6

32.0

Finance costs

7

(385.3)

(239.3)

Other financial income and expense

7

(188.9)

(47.2)

Income before tax of fully consolidated companies

(75.5)

276.1

Taxes

8

(186.3)

(138.8)

of which deferred taxes

8

181.4

95.0

Net income (loss) of fully consolidated companies

(261.8)

137.3

Share of net income of associates

13

11.4

(24.6)

Net income from continued operations

(250.4)

112.7

Net income from discontinued operations

2.3

0.0

(96.5)

Consolidated net income (loss)

(250.4)

16.2

Attributable to owners of the parent

(381.8)

(78.8)

Attributable to minority interests from continued operations

23

131.4

95.0

Attributable to minority interests from discontinued operations

0.0

0.0

Basic earnings (loss) per share (in €)

9

(2.20)

(0.57)

Diluted earnings (loss) per share (in €)

9

(2.20)

(0.57)

Basic earnings (loss) from continued operations per share (in €)

9

(2.20)

0.13

Diluted earnings (loss) from continued operations per share (in €)

9

(2.20)

0.13

Basic earnings (loss) from discontinued operations per share (in €)

9

NA

(0.70)

Diluted earnings (loss) from discontinued operations per share (in €)

9

NA

(0.70)

Other comprehensive income

(in € million)

Notes

2022

2021

Consolidated net income (loss)

(250.4)

16.2

Amounts to be potentially reclassified to profit or loss from continued operations

70.5

259.4

Gains (losses) arising on fair value adjustments to cash flow hedges

92.6

3.9

of which recognized in equity

82.5

10.9

of which transferred to net income (loss) for the period

10.1

(7.0)

Exchange differences on translation of foreign operations

2.8

256.6

Tax impact

(24.9)

(1.1)

Amounts not to be reclassified to profit or loss from continued operations

168.7

45.1

Actuarial gain/(loss) on post-employment benefit obligations

25

244.3

54.1

Tax impact

(75.6)

(9.0)

Other comprehensive income from discontinued operations

0.0

6.5

Total comprehensive income (expense) for the period

(11.2)

327.2

Attributable to owners of the parent

(150.8)

196.9

Attributable to minority interests

139.6

130.3

-

Note 11 Intangible assets

Note 11Intangible assets

A.Research and development expenditure

The Faurecia group incurs certain development costs in connection with producing and delivering modules for specific customer orders which are considered as set up costs for the serial parts production and capitalized. In accordance with IAS 38, these development costs are recorded as an intangible asset where the Company concerned can demonstrate:

- ■its intention to complete the project as well as the availability of adequate technical and financial resources to do so;

- ■how the customer contract will generate probable future economic benefits and the Company’s ability to measure these reliably;

- ■its ability to reliably measure the expenditure attributable to the contracts concerned (costs to completion).

These capitalized costs are amortized to match the quantities of parts delivered to the customer, over a period not exceeding five years except under exceptional circumstances.

Research costs, and development costs that do not meet the above criteria, are expensed as incurred.

B.Other intangible assets

Other intangible assets include development and purchase costs relating to software used within the Group –which are amortized on a straight-line basis over a period of between one and three years– as well as patents and licenses, and the intangible assets acquired in business combinations (customer relationship…); these assets are amortized on the corresponding contracts duration.

(in € million)

Development costs

Software

and otherIntangible

assets acquiredTotal

Amount as of January 1, 2021

2,059.7

74.2

534.1

2,668.0

Additions

671.7

5.6

0.0

677.3

Depreciation and amortization

(507.0)

(42.6)

(92.6)

(642.2)

Funding of provisions

19.5

0.0

0.0

19.5

Translation adjustments and other

24.5

29.0

24.2

77.8

Amount as of December 31, 2021

2,268.4

66.2

465.8

2,800.4

Additions

969.1

18.7

0.0

987.8

Depreciation and amortization

(680.0)

(40.7)

(218.6)

(939.3)

Funding of provisions

(45.4)

(0.5)

0.0

(45.9)

Translation adjustments and other

486.5

45.6

1,255.0 *

1,787.1

Amount as of December 31, 2022

2,998.6

89.3

1,502.1

4,590.1

* see note 10A.

The book value of development costs allocated to a customer contract as well as the associated specific tooling is compared to the present value of the expected net future cash flows to be derived from the contract based on the best possible estimate of future sales. The volumes taken into account in Faurecia’s Business Plans are the best estimates by the Group’s Marketing department based on automakers’ forecasts when available.

-

Note 28 Sundry payables

Note 28Sundry payables

-

1.4.Statutory auditors’ report on the consolidated financial statements for the year ended December 31, 2022

This is a translation into English of the statutory auditors’ report on the consolidated financial statements of the Company issued in French and it is provided solely for the convenience of English-speaking users.

This statutory auditors’ report includes information required by European regulations and French law, such as information about the appointment of the statutory auditors or verification of the information concerning the Group presented in the management report and other documents provided to shareholders.

This report should be read in conjunction with, and construed in accordance with, French law and professional auditing standards applicable in France.

Opinion

In compliance with the engagement entrusted to us by your annual general meeting, we have audited the accompanying consolidated financial statements of Faurecia for the year ended December 31st, 2022.

In our opinion, the consolidated financial statements give a true and fair view of the assets and liabilities and of the financial position of the Group as at December 31st, 2022 and of the results of its operations for the year then ended in accordance with International Financial Reporting Standards as adopted by the European Union.

-

1.5.Review of Company’s business and financial results

Faurecia S.E. company is a holding company which directly and indirectly provides financial, accounting, IT, executive management and administrative services to companies in the Group.

Faurecia invoices trademark royalties, calculated as a proportion of the subsidiaries’ sales. These royalties, extended since 2015 to all companies wholly owned by the Group, totaled €64.2 million in 2022, versus €52.3 million in 2021.

Results of operations

The operating profit for the year 2022 is a profit of €18.5 million to be compared to a loss of €24.5 million in 2021.

The net financial income totaled €314.0 million, compared to a net financial income of €218.2 million in 2021.

The variance is mainly due to the increase in dividends received from €208.2 million in 2021 to €277.3 million in 2022. Interest income, net of interest expense, represents €44.1 million, compared to €6.8 million in 2021.

Tax income amounted to €14.3 million, compared with €21.4 million for fiscal year 2021. This corresponds to the tax income recognized from the positive earnings of French subsidiaries that are part of the consolidated tax group.

Net income for the fiscal year showed a profit of €344.3 million (5). This compares with a profit €212.6 million in 2021.

-

1.6.Parent company financial statements

1.6.1.Income statement

(in € thousands)

Notes

2022

2021

Services sold

96,589

42,481

Sales

96,589

42,481

Outside services

(111,441)

(146,373)

Taxes other than on income

(2,685)

(2,133)

Salaries and wages

(15,524)

(4,883)

Payroll taxes

(7,937)

(2,435)

Amortization, depreciation and provisions (net of reversals) and expense transfers

3

(3,591)

37,215

Other income/(expenses)

4

63,061

51,583

Total operating income and expenses

(78,117)

(67,026)

Net operating income

18,472

(24,545)

Financial income

5

790,244

454,377

Financing costs

5

(476,261)

(236,186)

Net financial income (expense)

5

313,983

218,191

Operating income after net financial income

332,455

193,646

Non-recurring income

6

739

319

Extraordinary expenses

6

(3,160)

(2,828)

Net non-recurring income

6

(2,421)

(2,509)

Employee profit-sharing

(9)

(12)

Corporate income tax

7

14,300

21,426

Net income

344,325

212,551

-

1.7.Statutory Auditors’ report on the financial statements for the year ended December 31, 2022

This is a translation into English of the statutory auditors’ report on the financial statements of the Company issued in French and it is provided solely for the convenience of Englishspeaking users.

This statutory auditors’ report includes information required by European regulations and French law, such as information about the appointment of the statutory auditors or verification of the management report and other documents provided to the shareholders.

This report should be read in conjunction with, and construed in accordance with, French law and professional auditing standards applicable in France.

Opinion

In compliance with the engagement entrusted to us by your annual general meeting, we have audited the accompanying financial statements of Faurecia SE for the year ended December 31st, 2022.

-

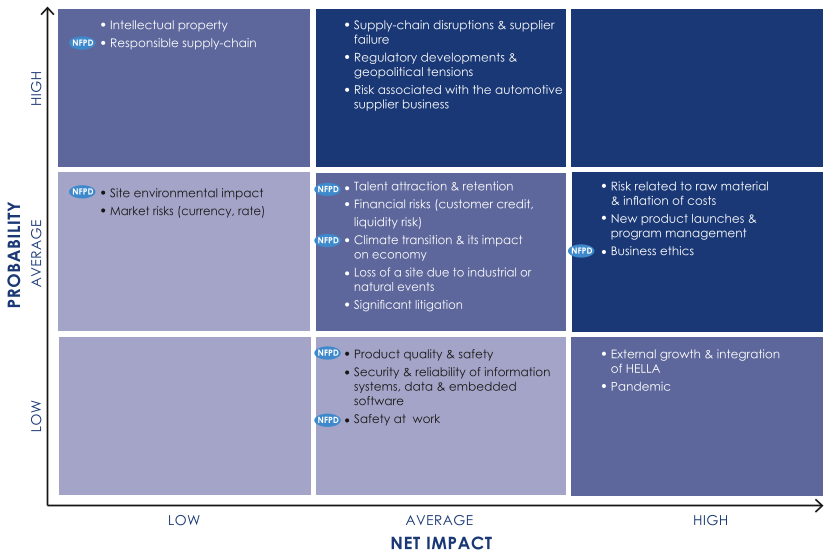

2Risk factors & Risk management

This section describes the parties involved in FORVIA Group's Enterprise Risk Management program (ERM) and the main risk factors to which the Group believes it is exposed as of the date of this Universal Registration Document. However, other risks that the Group is not aware of at the date of this Universal Registration Document, or which are not considered to date as likely to have a significant unfavorable impact for the Group, its Business Groups, its financial position, its results or its outlook, may exist or occur. It is one vision of Faurecia and HELLA Global Risk Leadership team.

-

2.1.Methodology and description of the main risk factors and their management

The Group operates its activities in an environment that is constantly changing. It is therefore exposed to risk factors that could result in events whose probability of occurrence and/or severity could adversely affect the achievement of its objectives in the short, medium or long term.

Methodology

The Group works every year on a risk tolerance mapping through a global approach that is broken down into several stages:

- the definition of the Group’s context and associated objectives; this forward-looking strategy phase is carried out at the beginning of the year as part of the strategic plan. Thanks to a bottom-up approach, for each product line, the deliverable is formalized with a SWOT analysis and a risk tolerance mapping. This includes three key elements:

- ■the uncertainties related to the global environment and the automotive sector,

- ■the threats, known or unknown, that could affect the Group’s objectives,

- ■the opportunities associated with the threats identified in order to achieve the Group’s objectives,

- A version is then consolidated by business groups with the entries of its product lines to form a Strategic risk mapping that represents the net impact in function of the time horizon; a final version is then consolidated for the Group;

- the risk assessment of which the Group is aware, with three phases:

- ■risk identification which is approached via various methods, including surveys and interviews with the main stakeholders at Group and business level,

- ■risk analysis by the causes and consequences to better qualify the risk parameters using a qualitative method,

- ■risk assessment using the prioritization method described below,

- the risk processing is done using 4 different levers so called 4T (terminate or avoid, treat or reduce, transfer or share or/and then tolerance the residual risk) and this thanks to risk control tools that apply for:

- ■the probability of occurrence with control measures, to anticipate the occurrence of any known and possible event,

- ■the impact (or severity) with appropriate mitigation plans, to limit the effects of any adverse event as far as possible.

The Group’s risk mapping changes each year according to the external and internal context. It is submitted to the Risk Committee for approval.

- ■the corruption risk mapping in application of the provisions of the Sapin II law;

- ■the extra-financial performance risk mapping in the context of the Non-Financial Performance Declaration.

Since 2022, more granular risk analyzes have been carried out at the level of functions, Business Groups or regions, and these feed into the Group’s vision. They also give more autonomy to the operational teams thanks to the deployment of tools and help to raise their awareness of risk management and culture. The result is formalized in the form of risk tolerance maps. They are specific to the scope in question and are accompanied by risk mitigation measures and plans.

The link between risk management and internal control is described in Section 2.2.2.2. “Internal control” in this section.

The assessment of the main risks takes into account the control measures implemented to reduce the risk (the risk is net or residual) and is based on a simplified risk tolerance mapping with a three-level scale:

- ■impact or severity (low/medium/high) which is characterized by financial, operational, reputational, human and/or legal criteria;

- ■the probability of occurrence (low/medium/high) which is characterized by a frequency.

In 2022, the Group created the ABC Risk class method to better control risk (see paragraph 2.2.4 RISK department).

The simplified mapping of the main risk factors is shown below. The different risk factors included in this matrix are detailed in this section. The risk mapping is an internal tool to manage these risk factors. It is validated by the Audit Committee and by the Board of Directors.

In addition to the simplified mapping of the main risks above, the following table provides a summary of the risk factors and the associated measures of control. The categories below are not set out in order of importance. However, within each category, the risk factors are set out in decreasing order of importance as determined by the Group at the date of this Universal Registration Document on the basis of an assessment of their probability and potential impact, taking into account mitigating measures (net risk). The assessment made by the Group of this ranking in terms of importance may however be modified at any time, in particular, in response to new events outside or within the Group. Moreover, even a risk that is currently considered to be of lesser importance could have a significant impact on the Group should it occur at a future date.

Other risks of which the Group is currently unaware, or which it does not consider significant at the date of this Universal Registration Document, could also affect its business.

Risk factors

Main risk control measures

Probability

Impact

Related Section

Operational & industrial risks

2.1.1

Supply-chain disruptions & supplier failure

- ■Qualification process of supplier panel according to specific criteria (innovation, quality, cost, cash, lead times, etc.)

- ■Systematic assessment of supplier risks during within dedicated Sourcing committees

- ■Integration of geopolitical, social, ethical, economic and financial risks

- ■Monthly monitoring of operational and financial performance

- ■Supplier development plan (logistics, quality, international development, etc.)

- ■Implementation of a supplier risk management solution

- ■Analysis of the capacity of suppliers beyond tier 2 for critical families

●●●

●●○

2.1.1.9.

Risk associated with the automotive supplier business

- ■Diversity of sales by region, by brand and vehicle model

- ■Constant monitoring of the competition

- ■Innovation and investment in Research & Development

- ■Forward management method enabling fine-tuning of the means of production

●●●

●●○

2.1.1.3.

New product launches & program management

- ■Existence of a standard organizing the succession of steps for the duration of a program

- ■Systematic risk assessment program as of the initial phase using 20 criteria

- ■Monthly review of programs and monitoring of action plans

- ■Regular audit of each development center and the industrial parks

●●○

●●●

2.1.1.5.

NFPD

Talent acquisition & retention

- ■Partnerships with more than 100 post-secondary institutions

- ■Specific on-boarding program for newvomers using a dedicated platform

- ■Internal mobility policy (including abroad)

- ■Regular reviews of the compensation policy

- ■Quantitative indicators through dedicated reporting

- ■Succession plans for key positions

●●○

●●○

2.1.1.12.

NFPD

Climate Transition & its impact on the economy

- ■Dedicated Project Director reporting to the Executive Committee

- ■Roadmap validated by the Science-Based Targets Initiative (SBTi)

- ■Special partnership with Schneider-Electric, Accenture, Engie, KPMG and Deloitte

- ■Performance indicator linked to variable compensation for management

- ■Risk mitigation plan with around 150 projects being rolled out

●●○

●●○

2.1.1.2.

Loss of a site due to industrial or natural events

- ■Industrial risk assessment model based on a framework of 15 assessment criteria

- ■Valuation of the existing portfolio of industrial parks using the aforementioned model

- ■Periodic audits conducted by the insurer and issuance of an RHP label

- ■Assessment of external factors (fire, climate risks, cyber, etc.)

- ■Systematic analysis and sharing of incidents

- ■Specific audits of most vulnerable sites carried out by technical experts

- ■Existence of a surveillance and real-time warning system for climate-related events

- ■Analysis of vulnerabilities to the climate transition of the portfolio of industrial parks

●●○

●●○

2.1.1.8.

External growth & integration of HELLA

- ■Strategic priorities set by the Board of Directors

- ■Control and allocation of necessary resources by a team of specialists

- ■This team is involved in the life of entities concerned and takes part in decision-making bodies

- ■Constitution of provisions as necessary

●○○

●●●

2.1.1.4.

Pandemic

- ■Updating our crisis management process

- ■Deployment of the “Safer Together” program applicable to all sites and conducting regular audits

- ■Implementation of cost reduction and cash protection measures

●○○

●●●

2.1.1.7.

NFPD

Site environmental impact

- ■Analysis and control of local environmental risks based on ISO 14001

- ■Monthly Environment & Energy Committee chaired by the Group’s HSE department

- ■Network of HSE managers at all levels of the organization (site, division, Business Group, Group)

- ■HSE requirements integrated into the Faurecia Excellence System

- ■Regular internal and Faurecia Excellence System audit of sites

●●○

●○○

2.1.1.11.

NFPD

Product Quality & Safety

- ■IATF 16949 certification

- ■Existence of a designated Quality Control department at all levels of the organization

- ■Measuring customer satisfaction

- ■Alert management system and problem solving with evidences

- ■Expert and independent auditors

●○○

●●○

2.1.1.6.

Security and reliability of information systems, data & embedded software

- ■Team of specialists dedicated to cybersecurity headed by the CISO

- ■Strategic plan dedicated to information systems risks (IT + OT)

- ■Regular audits of sensitive applications

- ■Precise methodology for computer science project management

- ■Existence of a Security Operation Center

- ■GDPR compliance program

- ■Regular simulation exercises pour Faurecia et HELLA

- ■Deployment of online training and an annual awareness campaign

●○○

●●○

2.1.1.1.

NFPD

Safety at work

- ■Existence of an HSE network at all levels of the organization

- ■Systematic accident analysis

- ■Mandatory training in HSE rules

- ■Regular audits of all sites and systematically in the event of an alert

- ■Ergonomic analysis of all workstations

- ■Regular “hazard hunting” in industrial parks

●○○

●●○

2.1.1.10.

Financial & market risks

2.1.2.

Risk related to raw material & inflation of costs

- ■Negotiations with customers and strict inventory management

- ■Raw material price fluctuations mainly passed on to customers on a “pass-through basis”

- ■Passing on to customers of price increases linked to inflation and impacting different cost items (energy, transport, labor, etc.)

●●○

●●●

2.1.2.4.

Liquidity risk

- ■Coverage of part of Faurecia’s liquidity requirements through receivables sale programs

- ■Regular issuance of commercial paper

- ■Diversified financial resources

●●○

●●○

2.1.2.1.

Customer credit risk

- ■Completion of a risk analysis prior to the acquisition of new customers

- ■Specific reporting on customer receivables

●●○

●●○

2.1.2.5.

Interest rate risk

- ■Centralized management of interest-rate hedges

- ■Decisions taken by a monthly committee on market risks

- ■Existence of a hedge policy implemented to limit the impact of short-term variations in interest rates on the Group’s earnings

●●○

●○○

2.1.2.2.

Currency risk

- ■Centralized management of currency hedging

●●○

●○○

2.1.2.3.

Legal, regulatory & reputational risks

2.1.3.

Regulatory developments & geopolitical tensions

- ■Network of legal, tax and financial experts

- ■Constant monitoring of laws and regulations in France and abroad

- ■Monitoring of a sanctions compliance process

●●●

●●○

2.1.3.1.

NFPD

Business ethic

- ■Global network of Compliance Officers

- ■Employee training and awareness raising

- ■Code of Ethics/internal procedures

- ■Anti-corruption risk mapping

- ■Third-party assessment process

- ■Accounting controls specific to the prevention and detection of corruption

- ■Existence of a whistle-blowing system

●●○

●●●

2.1.3.5.

Intellectual property

- ■Internal network of experts and specialists

- ■Global network of external advisors

- ■Performing patent searches and searches on old technologies

- ■Centralized Control of Technical and Legal Matters

●●●

●○○

2.1.3.4.

NFPD

Sustainable supply-chain

- ■Buy Beyond sustainable buying policy with a dedicated solution

- ■Systematic CSR analysis of new programs suppliers

- ■Required minimum score

- ■Quality audit of suppliers covering all aspects of CSR

- ■Existence of a whistle-blowing system

●●●

●○○

2.1.3.3.

Significant litigation

- ■Regular monitoring through dedicated reporting

- ■Adequate provisioning

●●○

●●○

2.1.3.2.

Note: The abbreviation NFPD indicates that this risk presents non-financial challenges, which are described in detail in Chapter 4 “Non-Financial Performance.” Identification of the primary CSR risks & opportunities is based on CSR risk mapping produced by the Group to supplement Group risk mapping. A risk universe (and the associated descriptions) was thus defined during a process that included consultations with internal and external stakeholders. Identified risks were rated by stakeholders. The risks selected are those with high criticality during this rating phase and have been approved by the Group’s Risk Committee.

- the definition of the Group’s context and associated objectives; this forward-looking strategy phase is carried out at the beginning of the year as part of the strategic plan. Thanks to a bottom-up approach, for each product line, the deliverable is formalized with a SWOT analysis and a risk tolerance mapping. This includes three key elements:

-

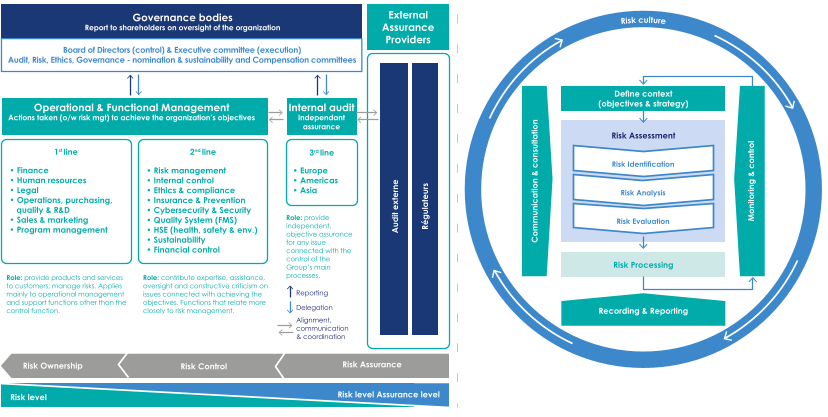

2.2.Contributors and global risk program

The Audit Committee, which is tasked with overseeing the effectiveness of the risk management program and the internal control system (which are not limited to accounting and financial risks), informs the Board of Directors of the main actions taken by the Group in this domain. Risk contributors provide information to the Audit Committee which conducts a formal annual review of the global risk management program and the internal control system.

The following diagrams provide a summary of the organization and processes of risk management & control within the Group.

2.2.1.Operational departments

The Group’s Executive Committee examines the major operational risks inherent to the Group’s business during the monthly meetings of the Operations Committee, and at least once per year it reviews the risk mapping prepared by the Group’s Risk Committee.

The Executive Management of each business (Business Group) is responsible for identifying and managing the operational risks inherent to its business, which are examined by the respective Operations Committee and Risk Committee. The operational and support functions direct and lead the actions, including risk management, necessary to achieve the Group’s objectives.

-

2.3.Insurance and risk coverage

The Group's asset protection policy is based on the implementation and ongoing adaptation of a policy of (i) preventing industrial risks and (ii) transferring the main insurable risks to the insurance market.

In addition, given the trend in claims and the unfavorable trend in the insurance market - in particular the increase in deductibles - Faurecia is de facto its own insurer to a certain extent. The Group has set up a captive reinsurance company based in Luxembourg in order to further structure this self-insurance. The Group obtained approval from the Luxembourg Insurance Commission in May 2021 and Forvia-Ré is now active in the Group's liability, property and casualty and business interruption insurance programs.

2.3.1.Fire, property damage and business interruption insurance

The Group has taken out a fire, property damage and business interruption insurance policy with a co-insurance group of major insurers led by FM Global.

Buildings and equipment are insured as replacement values. The guarantees are organized around a Master policy which directly covers the risks located in the area of freedom to provide services and local policies for subsidiaries located outside this area.

The premium rates applicable to exposed capital (direct damage and annual gross margin) depend directly on the Highly Protected Risk (HPR) classification assigned to the site, after audit by the insurer.

- ■June 2019: destruction following a fire at the plant belonging to the FCM supplier Modulo in Poland;

- ■November 2019: a fire in a workshop used for the manufacturing of flooring and trim and door panels in the Abrera plant in Spain following an outbreak of a fire on a painting production line.

These claims and general developments in the insurance market have led to a significant tightening of the program’s terms and conditions:

- ■a sharp increase in deductibles, particularly for major sites that are poorly protected or exposed to high natural risks;

- ■increase in the premium;

- ■increase in the deductible for failures, and reduction in the level of coverage provided for indirect failures (tier-2 and above suppliers, customer suppliers).

- ■monitoring by the Risk Committee of the fire protection action plans of the most vulnerable main sites;

- ■the launch of an analysis and a monitoring of the fire and natural risks of our main suppliers, in particular through the precise location of their production plants;

- ■the launch of a technical and an economic evaluation of the costs of securing sites exposed to a high risk of flooding, earthquakes, wind or snowfall.

The renewal of the Property & Casualty policy in July 2022 was affected by an indexation of values in countries affected by inflation. Actions to improve the reliability of reported values are underway to mitigate this effect.

Lastly, the increase in climatic hazards could increase claims related to natural events or trigger other events (heat waves, water scarcity, etc.) likely to affect the Group’s operations. A comprehensive analysis of the industrial park portfolio was carried out by an external partner in 2022, with the aim of anticipating the likely impacts of climate change on the most vulnerable industrial parks. Based on this risk analysis, an adaptation plan will be rolled out to the sites concerned from 2023.

Damage insurance is supplemented by builder’s risk insurance and insurance covering the transportation of goods or equipment and political risk.

A consolidation project of the various regional transport policies is currently ongoing. A call for tenders was launched to renew the Transport policy and was won by AXA XL, which became the Group’s insurer on January 1, 2022. Prevention actions are underway to control claims in countries affected by recurrent claims.

-

3Corporate governance

The information below constitutes the chapter relating to the corporate governance report as provided for by the last paragraph of Article L. 225-37 of the French Commercial Code.

Some of the information forming an integral part of the corporate governance report, as required by Articles L. 22-10-8 and L. 22-10-10 of the French Commercial Code, is included in other chapters of this Universal Registration Document. The cross-references included in this section indicate the chapter of this Universal Registration Document in which the relevant information can be found.

-

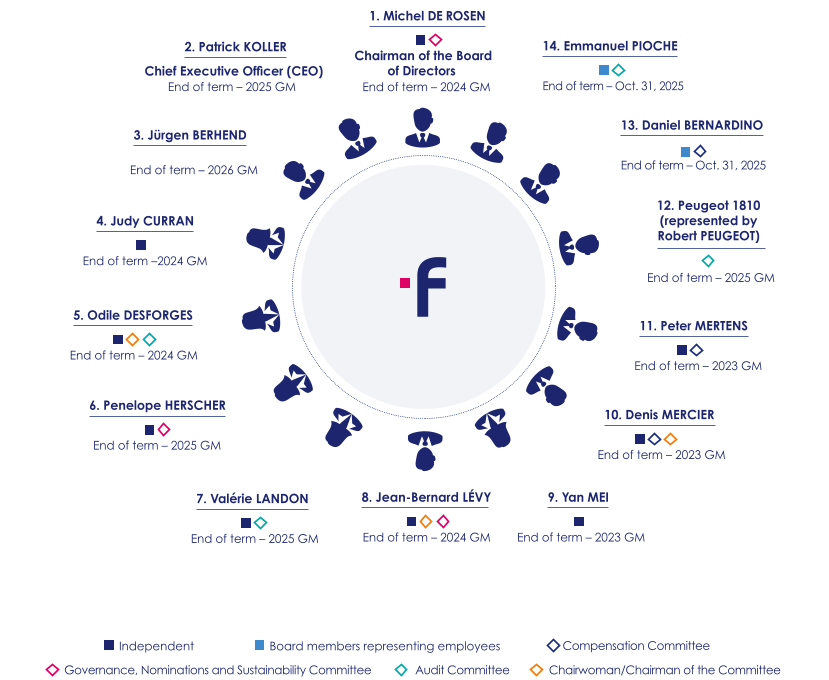

3.1.Board of Directors

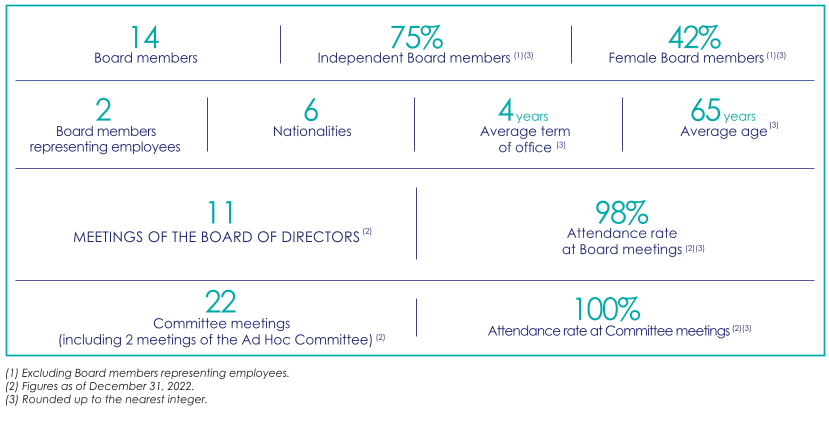

3.1.1.Summary presentation of the Board of Directors and key figures

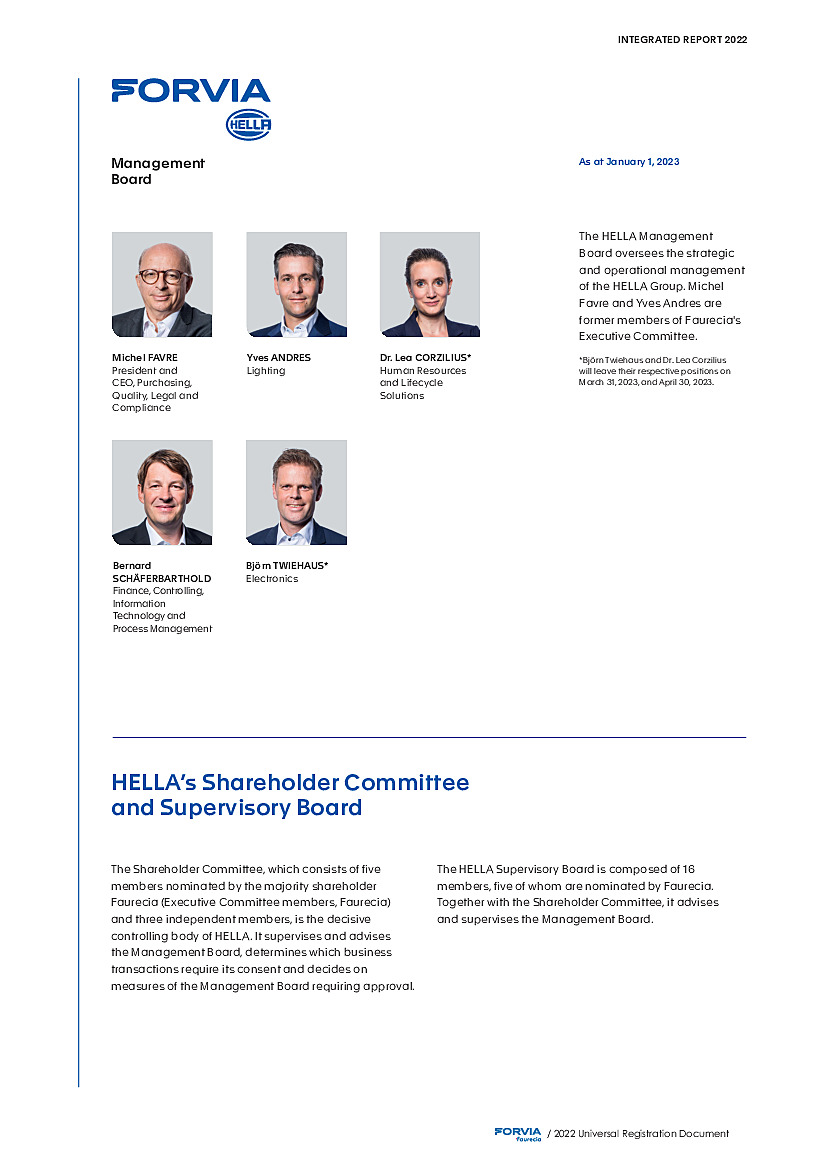

The diagram below summarizes the composition of the Board of Directors and the Committees (permanent) at the date of this Universal Registration Document:

-

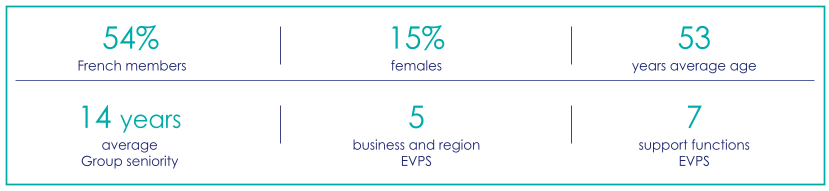

3.2.Operational management of the Group

In addition to General Management, the information about which is given in Section 3.1.2.4 “Governance structure and shareholder dialog”, the Group has an Executive Committee and is also supported by Group Leadership Committee (top 300). The diversity policy within the governing bodies is described in Chapter 4 “Extra-financial performance”, Section 4.4.2 “Diversity & Inclusion” of this Universal Registration Document.

As mentioned in Section 4.4.2 of this Universal Registration Document, Faurecia has set itself the goal of boosting the recruitment and internal promotion of women in order to increase the presence of women among engineers and executives and in the Group top management with targets at 24% in 2025 and at 30% in 2030 of women in the Group Leadership Committee (top 300). As at December 31, 2022, the TOP 300 leaders comprised 23% women (compared to 21% in 2021) evidencing a strong feminization dynamic in the top management. The feminization of the Group Leadership Committee (top 300), in particular by the 2030 horizon, allows to build the necessary “reservoir”, in order to accelerate the gender balance in the Executive Committee (given that the majority of the Executive Committee’s members comes from the Group Leadership Committee (top 300).

In this context, Faurecia has notably implemented ambitious actions and initiatives described in Section 4.4.2 of this Universal Registration Document, in particular, in terms of hiring, training and promotion of female talents. In 2023, the Group will continue its efforts in terms of the promotion of female talent, notably by implementing a new program referred to as “RISE” in favor of about 40 identified female talents (who may occupy top leaders positions, including Executive Committee member). This nine-month program includes collective coaching sessions, co-development exercises and networking events. It is overseen by four members of the Executive Committee, including the Chief Executive Officer. By developing female talent at the highest level, the Group wishes to develop a more inclusive management, allowing female potential to be developed in turn by these role models.

In addition, it is to be noted that recent performance share plans for the Group Leadership Committee (top 300) include an internal condition relating to gender balance, therefore supporting actions in favor of the feminization of top management.

Finally, the Board of Directors carries out, on an annual basis, a review of the succession plan of the Executive Committee (with a special attention to the percentage of women in the succession plan) and a specific review of the Group diversity policy.

3.2.1.Executive Committee

The Faurecia group’s Executive Management is provided, under the responsibility of the Chief Executive Officer, by an Executive Committee which meets at least once a month to review the Group’s results and deliberate on general Group issues, or as often as the interests of the Company require.

Composition of the Executive Committee

Patrick KOLLER

Chief Executive OfficerVictoria CHANIAL

Executive Vice President, CommunicationNolwenn DELAUNAY

Executive Vice President, Group General Counsel and Board Secretary to the Board of DirectorsOlivier DURAND

Executive Vice President, Group Chief Financial OfficerNik ENDRUD

Executive Vice President of the Americas regionFrank HUBER

Executive Vice President, Faurecia Automotive SeatingOlivier LEFEBVRE

Executive Vice-Chairman, Faurecia Clean MobilityJean-Paul MICHEL

Executive Vice-Chairman, Faurecia InteriorsChristopher MOKWA

Executive Vice President, Digital Transformation and StrategyThorsetn MUSCHAL

Executive Vice-Chairman, Sales and Program ManagementChristophe SCHMITT

Executive Vice President, Group OperationsJean-Pierre SOUNILLAC

Executive Vice-President, Human ResourcesFrançois TARDIF

Executive Vice President, Asia -

3.3.Compensation of corporate officers

3.3.1.Compensation of executive corporate officers for the 2021 and 2022 fiscal years

The Board of Directors, further to a proposal from the Compensation Committee, sets the compensation for executive and non-executive corporate officers in accordance with the applicable legal provisions and the compensation policy.

3.3.1.1.Compensation of the Chairman of the Board of Directors

3.3.1.1.1.Reminder of the principles of the 2022 compensation policy

The compensation policy setting the structure as well as the principles and criteria defined in order to determine the compensation and all benefits granted to the Chairman of the Board of Directors for the fiscal year ended December 31, 2022, which was 99.60% approved at the Company’s General Meeting held on June 1, 2022 pursuant to the 11th resolution, is set out in the Company’s 2021 Universal Registration Document, in Section 3.3.4.1 “Compensation policy for corporate officers”, and more specifically in Section 3.3.4.1.2. “Compensation policy for the Chairman of the Board of Directors”.

It should be noted that, in a summarized form, as in previous years, the 2022 compensation policy for the Chairman of the Board of Directors provided for fixed compensation, benefits in kind and social protection schemes.

The Chairman of the Board of Directors’ compensation, for the 2021 and 2022 fiscal years, as described below, complies with the compensation policy approved by the shareholders. It reflects the willingness of the Company to put in place a compensation system that is simple, stable, and compliant with market practices as presented to the shareholders.

3.3.1.1.2.Compensation paid during the 2022 fiscal year or granted for the same fiscal year

3.3.1.1.2.1. Fixed annual compensation

On February 18, 2022, the Board of Directors resolved to maintain the fixed annual compensation paid to the Chairman of the Board of Directors at €300,000. This has remained unchanged since 2017.

The fixed annual compensation of the Chairman of the Board of Directors, net of benefits in kind related to the provision of an assistant for his/her activities other than those relating to the chairmanship of Faurecia, amounted to €265,200 (excluding benefits in kind and social protection described thereafter). It was paid in full in 2022.

3.3.1.1.2.2. Benefits in kind and social protection

In addition to the provision of a personal assistant for activities other than those related to the chairmanship of Faurecia for an amount valued at €34,800, which is included in the above-mentioned €300,000 ceiling, the Chairman of the Board of Directors was provided with a company car. This benefit is valued at €6,624.

It is finally specified that the Company paid €4,692 in consideration of the supplementary health/life/disability pension scheme.

3.3.1.1.2.3. Other components of compensation

With the exception of the components described above, the Chairman of the Board of Directors did not receive any other compensation (including compensation for his duties as Board member), including by a company comprised in the scope of consolidation of the Company within the meaning of Article L. 233-16 of the French Commercial Code.

3.3.1.1.3.Compensation paid during the 2021 and 2022 fiscal years or granted for the same fiscal years

The tables below present the compensation and benefits paid during the 2021 and 2022 fiscal years or granted for these fiscal years to the Chairman of the Board of Directors.

It is stipulated that, since the Chairman of the Board of Directors receives only fixed compensation as well as benefits in kind and has social protection schemes, to the exclusion of any other compensation, tables No. 4 to No. 7 provided for by the AFEP-MEDEF Code and AMF recommendation No. 2021-02 are not applicable. The same applies to table No. 10 provided for by the AFEP-MEDEF Code.

Summary of compensation and options and shares granted to Michel de Rosen

Table No. 1 (AFEP-MEDEF Code and AMF recommendation No. 2021-02)

(in €)

2021 fiscal year

2022 fiscal year

Compensation granted for the fiscal year (see table No. 2)

310,070

311,316

Value of stock options granted during the fiscal year

-

-

Value of performance shares granted during the fiscal year

-

-

Value of other long-term compensation plans

-

-

Total

310,070

311,316

Summary of compensation payable to Michel de Rosen

Table No. 2 (AFEP-MEDEF Code and AMF recommendation No. 2021-02)

(gross in €)

2021 fiscal year

2022 fiscal year

Amount granted

Amount paid

Amount granted

Amount paid

Fixed compensation

265,200

265,200

265,200

265,200

Annual variable compensation

-

-

-

-

Multi-annual variable compensation

-

-

-

-

Exceptional compensation

-

-

-

-

Compensation awarded as a Board member

-

-

-

Benefits in kind(1)

44,870

44,870

46,116

46,116

Total

310,070

310,070

311,316

311,316

(1) This figure includes the provision of an assistant, the provision of a vehicle (5,393 euros for the 2021 fiscal year and 6,624 euros for the 2022 fiscal year) and also social protection (4,677 euros for the 2021 fiscal year and 4,692 euros for the 2022 fiscal year).

Table No. 11 (AFEP-MEDEF Code and AMF recommendation No. 2021-02)

Employment contract

Supplementary pension scheme

Compensation or benefits due or that may be due on termination or change in position

Compensation due under a non-competition clause

Yes

No

Yes

No

Yes

No

Yes

No

Name: Michel de ROSEN

Position: Chairman of the Board of Directors since May 30, 2017

Corporate office end date: 2024 GM

No

No

No

No

3.3.1.2.Compensation of the Chief Executive Officer

3.3.1.2.1.Reminder of the principles of the 2022 compensation policy

The compensation policy setting the structure as well as the principles and criteria established to determine the compensation and benefits of any kind granted to the Chief Executive Officer for the fiscal year ended on December 31, 2022, which was 85.19% approved by the Company’s General Meeting of June 1, 2022 in the 12th resolution, appears in the Company’s 2021 Universal Registration Document in Section 3.3.4.1 “Compensation policy for corporate officers”, and more specifically in Section 3.3.4.1.3. “Compensation policy for the Chief Executive Officer”.

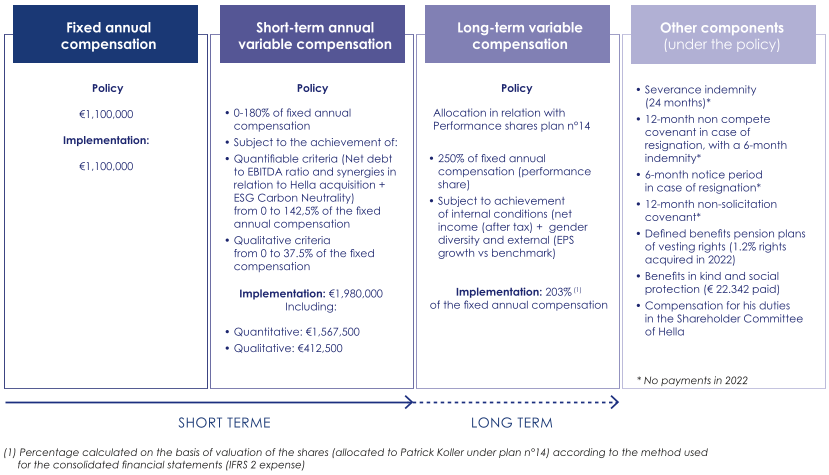

The compensation policy for the Chief Executive Officer for 2022 therefore provided for the following:

- ■a fixed annual compensation;

- ■a variable annual compensation, subject to performance conditions and representing up to a maximum of 180% of the fixed annual compensation;

- ■a long term compensation in the form of free share allocations subject to presence and performance conditions;

- ■termination payment;

- ■an indemnity in return for a non-compete commitment;

- ■a notice period and a non-poaching/non-solicitation commitment;

- ■additional defined contributions and benefits pension schemes;

- ■benefits in kind and social protection;

- ■compensation for his duties in the Shareholder Committee of HELLA.

The Chief Executive Officer’s compensation for the 2021 and 2022 fiscal years, as described below, is compliant with the compensation policy as approved by the shareholders. It reflects the Company’s will to elaborate a compensation system which is legible, competitive and that predominantly includes clear and precise performance criteria relating to the implementation of the strategy, the fulfillment of which is beneficial to all stakeholders.

3.3.1.2.2.Compensation paid during the 2022 fiscal year or granted for the same fiscal year

Compensation of the Chief Executive Officer in 2022

The 2022 fiscal year was marked by the transformation of the Group through the financial consolidation of HELLA. Although the economic context remained tense in 2022 in the automotive sector, and more particularly for equipment manufacturers, and the situation was aggravated by the geopolitical context, notably in Europe, the Company was able to demonstrate its resilience, strengthen its presence in its various regional markets, and support the development of promising technological segments. The actions taken to protect operating income, preserve cash and make fixed costs more flexible protected the Group's results during this period. The Group has also implemented its deleveraging strategy in accordance with the plan submitted to shareholders, which has resulted in the renegotiation of its debt and the sale of assets. The Group has initiated various synergy programs, including cost optimization synergies following the consolidation of HELLA. It has also pursued its ambitious carbon neutrality plan, which has produced effects in all the Group's sectors and geographies.

These achievements are reflected in the remuneration of the Chief Executive Officer in 2022, a significant part of which is based on the Group's performance, in particular for the short-term and long-term variable aspects.

3.3.1.2.2.1. Fixed annual compensation

On February 18, 2022, the Board of Directors, on the recommendation of the Compensation Committee, decided, subject to the adoption of the 2022 compensation policy by the Company’s General Meeting, to increase the fixed annual compensation as from January 1, 2022 for the Chief Executive Officer from €1,000,000 to €1,100,000, to take into account the new dimension of the Group following the acquisition of HELLA in January 2022 and the subsequent significant change in the responsibilities of the Chief Executive Officer. The proposed increase of 10%, which was approved by the general meeting dated June 1st, 2022, was based on a comparative study based on a group of comparable European industrial companies.

As a result, the fixed annual compensation of the Chief Executive Officer amounted to €1,100,000 for the 2022 fiscal year. This amount was paid in full in 2022.

3.3.1.2.2.2. Variable annual compensation

On the recommendation of the Compensation Committee, the Board of Directors set the procedures for determining the variable compensation of the Chief Executive Officer for 2022, in accordance with the 2022 compensation policy.

The table below summarizes the results of the analysis carried out by the Board of Directors on February 17, 2023, on the recommendation of the Compensation Committee, and assesses the levels of achievement of the quantifiable and qualitative criteria targets set in respect of the variable annual compensation for the fiscal year ended December 31, 2022:

Relative weight of each performance criterion

Minimum(1)

Target objective(1)

Maximum(1)

Achievement level

Amount in cash (€)

Assessment

Quantifiable (distribution of criteria on a 100% basis): from 0% to 142.50% of fixed annual compensation

Net-debt-to-EBITDA ratio (50%)

0%

100%

190%

190%

1,045,000

Exceeded targets for the execution of the deleveraging strategy over 2022, the deployment of the Faurecia/HELLA synergy plan with quantifiable impacts over 2022 and on a run rate basis, and the achievement of the carbon neutrality path objectives.

Synergies relating to HELLA integration (10%)

0%

100%

190%

190%

209,000

Quantifiable environmental criteria relating to carbon neutrality (15%)

0%

100%

190%

190%

313,500

Total quantifiable

-

-

190%

1,567,500

Individual (distribution of criteria on a 100% basis): 0% to 37.5% of fixed annual compensation

Order intake (25%)

0%

100%

150%

150%

412,500

Achievement of 2022 order intake targets, with associated margin.

Total qualitative

-

-

-

150%

412,500

Total

-

-

-

1,980,000

(1) The quantified amount of the objectives of the quantifiable criteria are not made public for confidentiality reasons.

- ■Quantifiable criteria:

- ■The criterion relating to the net debt to EBITDA ratio was defined by the Board of Directors with reference to the deleveraging trajectory following the acquisition of HELLA, and the targets were set in the Group's budget. Achievement was measured at June 30, 2022 and December 31, 2022, and the Board of Directors noted that the objectives had been reached to the maximum extent possible.

- ■The criterion relating to synergies from the integration of HELLA was defined by the Board of Directors with reference to the HELLA integration plan and the expected financial synergies at the level of the consolidated Group, and the objectives were set in the Group budget. Achievement was measured as of December 31, 2022, and the Board of Directors noted that the objectives had been reached to the maximum extent possible, both in terms of impact over 2022 and in terms of run rate impact.

- ■The environmental criterion linked to carbon neutrality has been defined by the Board of Directors with reference to the trajectory for achieving the Group's commitments (excluding HELLA) for 2025 and in line with the intermediate stage of 2023, as specified in the "sustainability-linked financing framework". Achievement was measured as of December 31, 2022 and the Board of Directors noted that the Group had reached its maximum target, with 35.9 tons of CO2 issued per million euros of revenue generated at Faurecia level.

- ■Qualitative criteria: given the objectives set and the results obtained, the qualitative criterion has been achieved to the maximum. The elements taken into account are detailed below.

- ■The amount of new orders in euros was achieved at the level of the Faurecia budget and overachieved when considering Forvia level ; operating margins associated with these orders were higher than the Faurecia and Forvia budgets set by the Board of Directors.

After examining the rate of achievement of the objectives of the criteria for the variable annual compensation for the 2022 fiscal year, the Board of Directors of February 17, 2023 noted that the total amount of the variable annual compensation for 2022 amounts to €1,980,000, compared to €300,000 for the 2021 fiscal year (and €270,000 for the 2020 fiscal year). Taking into account the amount of variable annual compensation for fiscal year 2022 resulting from outperformance relative to the quantifiable criteria, the relative proportion of fixed and variable annual compensation for fiscal year 2022 is as follows: 36% for fixed annual compensation and 64%for variable annual compensation.

In accordance with the provisions of Article L. 22-10-34 of the French Commercial Code, the variable compensation for the fiscal year ended December 31, 2022 shall be paid only after the shareholders, in a meeting to be held on May 30, 2023, have approved the components of compensation paid during the course of the 2022 fiscal year or awarded in respect of this fiscal year to Patrick Koller, Chief Executive Officer.

It is also acknowledged that the payment of Patrick Koller’s variable annual compensation for the 2021 fiscal year, which amounted to €300,000 was, in accordance with the law, subject to a favorable vote at the General Meeting of June 1, 2022 on the components of compensation paid or awarded in respect of the 2021 fiscal year (9th resolution). Since the vote in favor of this resolution was 92.41%, the payment of Patrick Koller’s variable annual compensation for the 2021 fiscal year was made after this General Meeting.

3.3.1.2.2.3. Performance shares

Introductory information: Plan delivered in 2022 / Plan for which the performance assessment took place in 2022 / Plan for which the performance conditions are set by reference to the 2022 fiscal year

In view of the capital increase carried out by the Company in 2022, the Board of Directors had the option to neutralize the impact of the transaction by adjusting the rights to receive shares in favor of the beneficiaries of Share Plans subject to performance conditions. This option was introduced by the regulations of Plan No. 11 of October 9, 2019, No. 12 of October 22, 2020, ESPI of July 23, 2021 and No. 13 of October 25, 2021 and transposed the applicable rules provided for in Articles R. 225-137 et seq. of the French Commercial Code, taking into account the ratio between the share price before and after the detachment of preferential subscription rights.

At its meeting of July 22, 2022, the Board of Directors decided that the number of performance shares to be delivered to beneficiaries of free share allocation plans whose vesting period is ongoing will be multiplied by 1.0788, the new number of shares obtained being rounded up to the next higher integer.

The non-achievement of the performance conditions of the internal and external quantitative targets, described in Chapter 5 “Capital stock and shareholding structure”, Section 5.2.2 “Potential capital” of the 2021 Universal Registration Document, are restated in the summary table below. As a result, no performance shares will be delivered under Plan No. 10.

The Board of Directors, at a meeting held on October 9, 2019, on a recommendation from the Compensation Committee, resolved to grant a maximum of 1,147,260 performance shares, including 56,220 to Patrick Koller. In addition to a condition of presence, this grant is subject to (i) an external condition of net earnings per share assessed between the 2018 fiscal year and the 2021 fiscal year, by comparison with a reference group of global automotive suppliers, weighting 30%, (ii) an internal condition related to the Group net income (after tax) at December 31, 2021, weighting 60% and (iii) a CSR internal condition related to gender diversity within the “Managers and Professionals” category (Group executives), weighting 10%.

At its meeting of February 18, 2022, the Board of Directors noted, on the recommendation of the Compensation Committee (i) the non-achievement of the quantified objectives of the internal condition related to the Group’s net income (after tax) as assessed at December 31, 2021 (weighting of 60%) and (ii) the achievement of 115% of the internal CSR condition linked to gender balance within the “Managers and Professionals” category at December 31, 2021.

At its meeting of April 21, 2022, the Board of Directors noted, on the recommendation of the Compensation Committee, the non-achievement of the external condition linked to the net earnings per share of Plan No. 11.

As a consequence and given the decision made by the Board of Directors on July 22, 2022 to proceed to an adjustment of the number of unvested rights related to the Performance Share Plans (following the capital increase carried out by the Group), the number of shares that will therefore be delivered to the Chief Executive Officer in October 2023 will be 5,365 shares.

The Board of Directors, at a meeting held on October 22, 2020, on a recommendation from the Compensation Committee, resolved to grant a maximum of 1,384,630 performance shares, including 61,140 to Patrick Koller.

In view of the decision of the Board of Directors on July 22, 2022 to adjust the rights to performance shares subject to performance conditions not yet vested (following the capital increase carried out by the Group), the maximum number of performance shares now granted to Patrick Koller has been adjusted to 65,958 under Plan No. 12.

In addition to a condition of presence, this grant is subject to (i) an external condition of net earnings per share assessed between the 2019 fiscal year and the 2022 fiscal year, by comparison with a reference group of global automotive suppliers, weighting 30%, (ii) an internal condition related to the Group net income (after tax) as of December 31, 2022, weighting 60% and (iii) a CSR internal condition related to gender diversity within the “Managers and Professionals” category (Group executives), weighting 10%.

The impact of the integration of HELLA into Faurecia's accounts as from 2022, as well as exceptional events such as the war in Ukraine and the level of vehicle production, have been restated from the internal target criterion for net income after tax under Plan No. 12 by decision of the Board of Directors on July 22, 2022, while maintaining the same trajectory curve.

The completion of the internal conditions and the external condition of Plan No. 12 will be assessed by the Board of Directors at its meeting reviewing the sales revenue of the first quarter of 2023.

The Board of Directors, at a meeting held on October 25, 2021, on a recommendation from the Compensation Committee, resolved to grant a maximum of 1,389,000 performance shares, including 96,150 to Patrick Koller.

In view of the decision of the Board of Directors on July 22, 2022 to adjust the rights to performance shares subject to performance conditions not yet vested (further to the capital increase carried out by the Company), the maximum number of performance shares now granted to Patrick Koller has been adjusted to 103,727 under Plan No. 13.

The Board of Directors, at a meeting held on July 23, 2021, on a recommendation from the Compensation Committee, resolved to grant a maximum of 673,549 performance shares, including 71,941 to Patrick Koller.

- ■50% of the rights subject to a condition of Annual Relative TSR, with a level of achievement noted each year, over a period of five years, giving rise to a maximum annual partial vesting of 20% of the tranche of the year in question. The total amount of the definitive grant under the Annual Relative TSR will be equal to the sum of the five years of partial vesting of the Annual Relative TSR.

- ■50% of the rights subject to a condition of Average Relative TSR 5 Years, not giving rise to any partial vesting, the level of realization being calculated at the end of the five-year reference period and taking into account all the Relative Annual TSR of the period.

In view of the decision of the Board of Directors on July 22, 2022 to adjust the rights to performance shares subject to performance conditions not yet vested (following the capital increase carried out by the Group), the maximum number of performance shares now granted to Patrick Koller has been adjusted to 77,610 as part of the ESPI plan.

In addition, at its meeting of July 22, 2022, the Board of Directors, on the recommendation of the Compensation Committee, noted the non-fulfillment of the first tranche of the annual relative Total Shareholder Return (TSR) condition (i). Consequently, the maximum number of shares remaining for the Chief Executive Officer is 69,848.

The conditions for the definitive acquisition of these shares described above, as well as the consequence of the neutralization of the capital increase, are set out in Chapter 5 "Capital stock and shareholding structure", section 5.2.2 "Potential capital stock" of this Universal Registration Document.

The table below summarizes, for the three Plans No. 10 to 12, described above, the maximum number of shares to be allocated to the Chief Executive Officer, the rate of achievement of the performance conditions, the rate of vesting and the number of shares delivered (or to be delivered) to the Chief Executive Officer:

Plan No. 10

Plan No. 11

Plan No. 12

Maximum number of shares initially allocated

27,000

56,220

61,140

Maximum number of shares after capital increase adjustment

60,651

65,958

Achievement rate of performance conditions

Internal condition of net income : 0%

External condition: 0%

Internal condition of net income : 0%

External condition: 115%

Internal and external conditions: assessed by the Board of Directors at its Q1 2023 sales meeting

Rate of allocation (vesting)

0%

11.5%

Number of shares delivered (or to be delivered) to the Chief Executive Officer

0

4,973

-

Number of shares delivered (or to be delivered) to the Chief Executive Officer after adjustment related to the capital increase

5,365

-

Plans awarded in 2022

Plan No. 14 awarded

At a meeting held on July 28, 2022, the Board of Directors, on a recommendation from the Compensation Committee, resolved, on the basis of the 20th resolution of the General Meeting of June 1, 2022, to grant a maximum of 2,388,290 performance shares, of which 169,830 performance shares (i.e., 0.086% of the capital stock at December 31, 2022) to Patrick Koller .

The valuation of the grant, according to the standards used for the consolidated financial statements, amounts to €2,228,170, i.e., 203% of the reference fixed compensation.

The internal and external conditions of Plan No. 14 as well as the objectives for the Chief Executive Officer are presented in the table below:

Relative weight of each performance criterion(1)

Minimum(2)

Target objective

Maximum

Assessment

Internal condition: Group net income after tax (excluding exceptional tax credits) for the fiscal year ended on December 31, 2024, before taking into account capital gains on asset disposals and changes in scope, such as decided by the Board of Directors (“Net income 2024”), assessed against the same income anticipated for the same fiscal year by the Group’s strategic plan (“SP Net Income”).

Weighting: 60%

Net Income 2024 = 90% of the SP Net Income target

Net Income 2024 = SP Net Income target

Net income for 2024 ≥ 110% of the SP Net Income target

For all conditions:

- ■between the thresholds, linear progression

- ■assessment of performance at the beginning of the 2025 fiscal year

Internal condition: Gender balance (% of women) in the Group’s “Managers and Professionals” category at December 31, 2024 compared to the targets set by the Board of Directors.

Weighting: 10%

-1 point

100% of the target

≥ +2 points

External condition: Level of growth in Faurecia’s net earnings per share between the 2021 and 2024 fiscal years (“Faurecia EPS”), assessed against the weighted growth of a reference group comprised of 12 comparable international automotive suppliers(3) (“Benchmark EPS”).

Weighting: 30%

Hypothesis 1: Benchmark EPS

≤ -20% (therefore negative)

Faurecia EPS = 125% Benchmark EPS

Hypothesis 2:

-20% < Benchmark EPS < +20%

Faurecia EPS = Benchmark EPS -5%

Hypothesis 3: Benchmark EPS ≥ +20%

Faurecia EPS = 75% Benchmark EPS

Hypothesis 1: Benchmark EPS

≤ -20% (therefore negative) /